2016

IFD members: 172

NFD members: 285

Fraud loss prevented by Cifas members:

£1,028,777,942

Cifas was invited to participate in the Home Secretary’s initiative to collaborate to reduce fraud – the Joint Fraud Taskforce was founded in February.

Lady Barbara Judge, pictured, succeeded Ken Cherrett as Chairman, and a new Advisory Board including a Citizens’ Advocate was launched.

Our first video ‘Data to Go’ went viral – nearly 2 million views on Facebook and Twitter.

Another £1 billion in fraud loss was prevented.

2015

Fraud loss prevented by Cifas members: £1,104,025,083

Our 'Fraud Investigations Database' (FIND) was relaunched and our new refreshed brand went public.

For the second year running, we prevented over £1 billion in fraud loss.

The Joint Money Laundering Intelligence Taskforce (JMLIT) was created and Cifas was invited to participate.

2014

Fraud loss prevented by CIFAS members: £1,106,639,324

After consultation with the Home Office, the CIFAS Immigration Portal was created in order to allow retail banks to comply with the provisions of the Immigration Act 2014

In the same year, UK deceased data was made available to our members.

2013

IFD members: 110

NFD members: 232

Fraud loss prevented

by CIFAS members:

£968,445,226

We had our 25th anniversary and Simon Dukes was appointed as the new Chief Executive

2012

Fraud loss prevented by CIFAS members: £762,418,971

CIFAS succeeded in its first attempt in achieving Investors in People (IIP) standard accreditation. IIP specialises in transforming business performance through people.

2011

Fraud loss prevented by CIFAS Members: £550,993,336

Five public sector bodies became members of CIFAS: the Legal Services Commission, the Financial Services Authority, the Student Loans Company, the Big Lottery Fund and the (then) UK Border Agency.

2010

Fraud loss prevented by CIFAS Members: £513,920,204

CIFAS welcomed its first public sector member: the Legal Services Commission.

2009

Fraud loss prevented by CIFAS members: £857,322,275

CIFAS partnered with Teesside University to develop the CIFAS foundation degree in Fraud Management.

A new case type 'Confirmed Fraud Risk' was built into CIFAS. Royal Mail and their cancelled 'mail redirects' were the first Confirmed Risk Fraud case type with £9 million savings reported by members.

The National Fraud Intelligence Bureau (NFIB) launched. We have provided it with data from the National Fraud Database since inception and we continue to be one of its largest data providers.

2008

IFD members: 55

NFD members: 241

Fraud loss prevented by CIFAS Members: £848,304,084

Fraud loss prevented by CIFAS Members: £848,304,084

Over the past 20 years CIFAS had prevented a total of £5 billion in fraud loss. CIFAS took part in the National Fraud Intelligence Bureau (NFIB) 'Proof of Concept' in 2008. The NFIB is still hosted by the City of London Police (CoLP).

2007

Fraud loss prevented by CIFAS members: £987,829,077

CIFAS was designated by the Home Office as a Specified Anti-Fraud Organisation (SAFO) under section 68 of the Serious Crime Act.

The first Alternative Lenders joined CIFAS membership.

CIFAS launched a new Bulk Protective Registration Service to help those companies who suffer data breaches.

2006

Fraud loss prevented by CIFAS members: £789,816,426

CIFAS supplied Essex Police with 15 prolific identity fraud addresses and case details, to help tackle serious and organised criminals and demonstrate the link between fraud and other serious crime types. A number of arrests were made and crimes uncovered ranged from drugs offences, to handling stolen goods, and attempted murder.

The Staff Fraud Database (now the Internal Fraud Database) was launched in consultation with the Chartered Institute of Personnel and Development (CIPD), Trades Union Congress (TUC) and Information Commissioner's Office (ICO).

CIFAS and SOCA (now the National Crime Agency) carried out a data match between the National Fraud Database and Suspicious Activity Reports. 25% of Suspicious Activity Reports matched to a fraud record in the National Fraud Database, highlighting the strong connection between fraud and money laundering.

Also in 2006, we welcomed the appointment of a CIFAS Single Point of Contact (SPOC) at every police force in the UK.

2005

Fraud loss prevented by CIFAS members: £681,545,210

In a joint initiative with law enforcement and the commercial sector, CIFAS began designing vehicle fraud. The system, linked to ANPR cameras, contained details of fraudulently obtained and stolen vehicles to aid their recovery. The vehicle fraud project closed in 2008 due to withdrawal of Kent connectivity, a lack of sponsorship within Kent Police and the withdrawal of a major insurance sponsor.

The Organised Fraud and Intelligence Group (OFIG) began in 2005. It is made up of members, law enforcement and government partners, and provides a route for intelligence and investigation professionals to share information about fraud threats, trends and enablers.

2004

Fraud loss prevented by CIFAS members: £673,456,739

CIFAS launched the Fraud Check scheme. The scheme gave members a reciprocal method of checking the validity of bank details, contact details, documents, etc, in the course of a fraud investigation.

2003

Fraud loss prevented by

CIFAS members:

£486,969,948.

CIFAS launched the 'Fraud Investigations Database' (FIND) supported by LogicaCMG, the largest project in our then 15 year history.

Delivered on time and to budget, it set out to deliver £2.5 million per year in reduced operational costs to CIFAS members for an outlay of just over £1 million. It offered access to our data 24 hours a day, 7 days a week.

CIFAS launched the first ever UK Identity Fraud Index in January. Developed from data supplied by 200 members, the index was designed to highlight the business sectors being targeted by fraudsters and organised crime. The index gained considerable media interest, with a feature appearing on Teletext!

2002

Fraud loss prevented

by CIFAS members:

£360,214,061

Application fraud was the most common type of fraud – individuals were hiding adverse credit information or fabricating their employment and/or salary in applications for credit.

2000

Fraud loss prevented by

CIFAS members:

£210,000,000.

Identity fraud looked very different – there was very little current address fraud, it was predominantly previous address fraud (where the victim's genuine current address is given as the previous on the application).

The administration of GAIN, the Gone Away Information Network transferred to CIFAS.

1999

Fraud loss

prevented by

CIFAS members:

£165,378,118

The first insurers joined CIFAS membership. Peter Hurst was appointed as Chief Executive:

1998

Fraud loss prevented by CIFAS members:

£136,585,310.

CIFAS had 160 members comprising banks, building societies, retailers, telecommunications and leasing and hire companies.

1997

Fraud loss prevented by CIFAS members:

£113,526,887.

A common fraud modus operandi was an individual walking into a retailer with false documents in order to try and walk out with expensive electronics on store credit. They would hope Saturday staff didn't scrutinise the documents too carefully.

1994

Fraud loss prevented by CIFAS members: £28,150,000.

CIFAS introduced a Protective Registration service the following year in 1994 to help protect victims of stolen cards, etc.

1991

Fraud loss prevented by CIFAS members: £15,820,000.

CIFAS became a not-for-profit company limited by guarantee with a Board elected from the membership, the credit reference agencies and one representative from the police and National Consumer Council (NCC). Ken Cherrett (pictured) was approached to become Chairman.

1990

Fraud loss prevented by CIFAS members: £10,500,000

Alan Hilton was appointed Chief Executive.

Fraud cases were live for six months.

1989

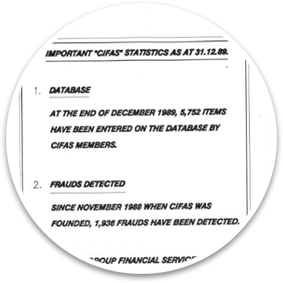

Our membership increased to 38. Highlights from the first year of CIFAS included these statistics: 5,752 items entered by CIFAS members; 1,936 frauds detected.

1988

On 5 November, CIFAS, then known as the Credit Industry Fraud Avoidance System, was launched. The eight-strong team all had other jobs. The seven founding members were all retail credit providers. From 1988 until 2003 members recorded their cases via the credit reference agencies (CRAs), by fax or post, then a CRA mainframe system, and finally by the Fraud Investigation Database (FIND).

1987

At a seminar in 1987 for the credit industry, Detective Superintendent Graham Balchin urged industry leaders to cooperate to reduce fraud. He advised them to stop regarding it as a competitive issue that they relied solely on the police to resolve.

Fraud loss prevented by CIFAS Members: £848,304,084

Fraud loss prevented by CIFAS Members: £848,304,084