Finding new ways to identify internal fraud

11 June 2020

The insider threat is evolving - now more than ever following the COVID-19 outbreak. Organisations may be finding that they are more vulnerable to fraud and that the risk of internal threats has increased.

Many organisations have been forced to change the way they work, with remote access and home working becoming the norm. These changes mean that security and system access could be bypassed or compromised more easily during this transitional period, creating the opportunity for internal fraud. Ways of working and codes of conduct in office environments are not always relevant or applicable in a home working environment and some staff may feel disconnected from their colleagues and managers which could tempt them to commit internal fraud.

Equally employees are potentially under increased stress and pressure at work and at home, which may lead some to feel disgruntled at becoming furloughed or at facing potential job loss. It is conceivable that some might be tempted to commit frauds against their employers now more than previous.

Even without COVID-19 hitting businesses across the nation internal fraud filings were already on a steady incline. Cifas members are filing an increased number of cases with filings up 13% compared to 2018 with the main contributors involving dishonest actions by staff (up 30%) and employment application fraud (up 10%).

Only by sharing information across all industries and capitalising on the decades of expertise in combatting fraud that Cifas offers can businesses effectively prevent new tactics and strategies of fraud from taking root. - Keith Rosser, Founder of REED Screening and Chairman at SAFERJobs.

Year on year, data from the Cifas National Fraud Database also shows that threats from misuse of credit services (up 2% from 2018), false insurance claims (up 54% from 2018), and application fraud (up 10% from 2018) consistently posing a major threat.

So what happens when consumers who commit these frauds have, or want employment and are seeking jobs in sectors ranging from banking and insurance, to charities and the public sector? These individuals may not have committed fraud against their employer or organisation, but they show that they may have the motivation and circumstances to do so.

This is where IFD Enhanced comes in.

Previously our Internal Fraud Database (IFD) members could only search employees and vet applicants against data only held on the IFD. Now with IFD Enhanced members can search data integrated with our National Fraud Database. This is a game changer for internal fraud prevention.

IFD Enhanced helps employers not only spot if applicants have committed internal fraud against a previous employer, but if they have committed any form of fraud at all.

Let’s talk benefits:

- Increases the chances of a match by 90%;

- Search over 550 member organisations who record first party fraud;

- Reduce non meaningful results by 50%;

- Manage all results from a single screen, optimising and streamlining the process;

- Screen against 690,000 cases of data;

- Access expert advice and intelligence on the Cifas Portal.

Every organisation has something to benefit from screening employees and potential employees.

Clear indications of trustworthiness can also be used as a selling point for acquiring new clients. Ultimately, a robust anti-fraud stance can be revenue generating. - Cifas' Fraudscape, 2019

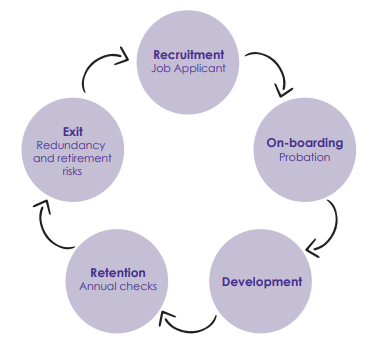

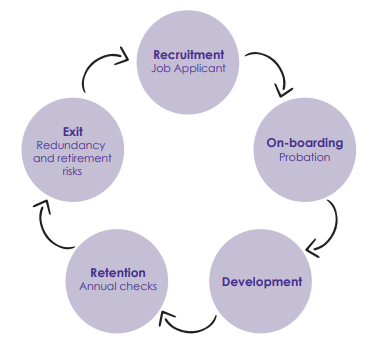

The star of your employee lifecycle

In 2019 it was recorded that 38% of UK businesses experienced internal fraud, which ranks 11% higher than the global average. When you add IFD Enhanced capabilities to your bag of tools, you are not only safeguarding your organisation and staff at the hiring process, but throughout their employee lifecycle.

Equip your management, HR department and vetting specialists to thoroughly screen job applicants as well as all current employees.

There is a common practice among many firms that once the vetting process is complete that the job is done, but this can be a very dangerous practice. Our 2019 Strategic Intelligence Assessment shows that most internal fraud cases likely involve staff that have been employed between one and five years.

Continuing checks for all employees throughout their employment helps create an anti-fraud culture and outlines to all employees, present and future, that you take internal fraud seriously.

FAQs

How do I get or discuss IFD Enhanced?

IFD Enhanced will be live for current IFD members on Monday 15 June. Contact your Member Relationship Manager or email business.development@cifas.org.uk to upgrade.

If you are not yet a member and want to learn more, contact us at newmembers@cifas.org.uk.

Is IFD Enhanced optional?

We are offering existing IFD members a chance to implement this game-changing feature in 2020 as the additional benefits are so wide-ranging.

Is there an additional cost for IFD Enhanced?

As IFD Enhanced enables organisations to access our National Fraud Database and vastly expand the wealth of data they can view and interrogate, there is an additional fee to reflect this. Contact your Member Relationship Manager or email us to discuss what this will be for your organisation. As always, our fees are fair and reflect our not-for-profit nature.

Posted by: Tracey CarpenterTracey is Cifas' Insider Threat Manager

PREVIOUS POSTNEXT POST

Furlough fraud: a moral dilemma?

22 June 2020

Many have been forced to make difficult decisions and it’s a sad truth that some business owners may be forced to decide what they think is the lesser of two evils, potential prosecution or the loss of the business.

CONTINUE READING

Coronavirus: fraudsters target home workers

29 May 2020

A mass amount of firms have made the transition to work from home. With this move comes many vulnerabilities left available for fraudsters to exploit.

CONTINUE READING

Back to blog home >